Take These 3 Steps to Raise More Capital Fast

If you feel like the capital raising environment is hostile right now, you’re not alone.

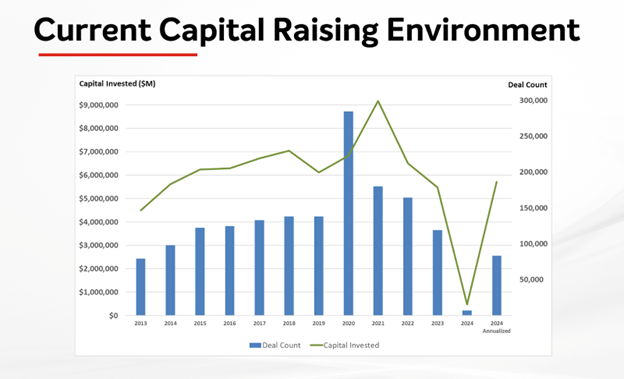

According to Pitchbook, volume of capital raising is down 65-70% over the last few years, and it looks like that decline will continue as macroeconomic trends dampen investor activity. Whether this decline marks the beginning of an economic slowdown or is part of a shorter “correction” is still up in the air. What matters for your business? Venture capital and private equity firms are pickier about the deals they pursue.

“At some point, we expect that the markets should improve as investors get more confident that interest rates have stabilized,” says CEO Coach and financial expert Rick Kimball. “But the last few years have certainly been a challenging environment to raise capital.”

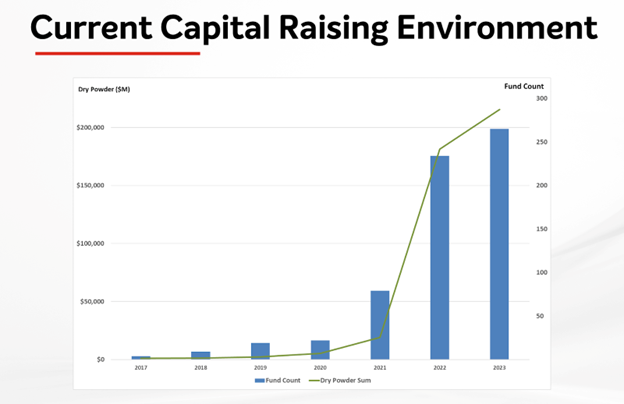

The silver lining to this market environment is that firms are sitting on unprecedented amounts of capital—in 2023 alone dry powder topped over $200 billion—which will be deployed over the next six to 10 years for businesses like yours.

That’s a boatload of cash.

And when it comes to valuations over time, EBITDA valuations peaked at 11.5X revenues a few years ago down to 6.2X. That’s across many diverse company portfolios, but it’s clear a valuation reset has occurred in the market. However, Rick sees this as an opportunity. “I’d argue that 7.5X EBITDA is not a terrible bottom for the market to find. That, plus the amount of cash available, makes me optimistic about the future,” he says.

Whether you’re raising capital in boomtimes or facing macroeconomic headwinds like the current environment, there are three main steps you can take to make sure your business is ready for your first round:

1. Get the BIG financial picture

The most important decision-making tool as you move forward with capital raising is your financial model. Not only does this make sure you understand how you’re performing and what you need to do to grow, but it is also how external firms evaluate your business.

“Getting your house in order is absolutely critical for raising capital, and the key to that is building the right financial model,” says CFO coach Daniel Kim. “Start with your income statement, which drives your balance sheet and cash flow.”

Daniel recommends starting with a five-year model for investors and zeroing in on your one- and three-year plans in particular. But the benefit of doing an analysis like this is not just for board presentations or for investors: It’s for your internal team as well. Says Daniel, “I highly recommend you do this analysis on a monthly basis as a best practice for monitoring and tracking your business. A five-year forecast gives you a great view of short-term and long-term growth prospects, which you can compare against your budget.”

2. Know your company’s value

VCs and PEs want to see big returns on their investment. While your product and purpose matter, it all comes down to how much value your company can generate for them. While they’ll likely do a valuation on their own if they’re serious about your business, it’s important to go through this exercise internally as well.

In simplest terms, a company valuation subtracts liabilities from assets. There are plenty of different methodologies for valuation, but we recommend starting with your income statement and EBITDA to get equity value per share. At CEO Coaching, we’ve built a series of templates to walk you through each step of the valuation process so you can easily calculate your worth—and start negotiating right away.

“This gives us a tool to really dig down into a quick overview of your company, find where the value drivers are, and what we need to do to make that happen in real life,” says Daniel. This is what’s going to start the conversation with the people behind the capital: Your investors.

3. Build a go-to-market plan

Once you have your financial model and your company valuation, you can start to make decisions about how you’ll use that capital once you receive it. Understanding your go-to-market plan determines the type of capital you want to raise.

“Ask yourself, ‘Am I buying a cash-flowing asset or investing in a cash point asset? Am I buying a company or investing in a project that’s going to have its returns in a few years?’” says Rick. “That’s going to influence whether you think you can do debt financing or equity financing.”

Debt financing borrows money to achieve a goal, while equity financing sells a portion of ownership of the company. While both VC firms and PE firms expect a return on their investment, the “cost” looks different to fuel your growth.

“It’s also critical to select an effective placement agent for the type of capital you’re raising,” says Rick. “Find either a bank or broker who can help intermediate the process and help you get to market. A lot of companies try to raise capital on their own, but it’s hard to do that if you don’t have the right investor relationships in place already.”

You want to find investors that really get your business and why what you’re doing matters. They have to believe in you as a leader and your product or service if you want to have a productive relationship. That includes the right kind of financing for where your company’s needs are. “You want to have a story around your business that allows investors to understand your competitive strengths and why you’re going to be an interesting instrument to own in a given industry.”

Raise capital quickly with CFO Coaching

Whether you’re looking for your first seed round or are taking the next step with your business for acquisition or a successful exit, our team of experienced CFO coaches has been there before. It’s no secret that raising capital is a BIG challenge, even in a bull market. In today’s volatile economic climate, you need all the help you can get. See how we can help >

About CEO Coaching International

CEO Coaching International works with CEOs and their leadership teams to achieve extraordinary results quarter after quarter, year after year. Known globally for its success in coaching growth-focused entrepreneurs to meaningful exits, CEO Coaching International has coached more than 1,000 CEOs and entrepreneurs in more than 60 countries and 45 industries. The coaches at CEO Coaching International are former CEOs, presidents, or executives who have made BIG happen. The firm’s coaches have led double-digit sales and profit growth in businesses ranging in size from startups to over $10 billion, and many are founders that have led their companies through successful eight, nine, and ten-figure exits. Companies working with CEO Coaching International for two years or more have experienced an average revenue CAGR of 31% (2.6X the U.S. average) and an average EBITDA CAGR of 52.3% (more than 5X the U.S. average).

Learn more about executive coaching | Meet our world-class coaches