Guest: Chris Hurn, the founder and CEO of Fountainhead Commercial Capital. Fountainhead is a nationwide non-bank direct commercial lender that specializes in funding commercial real estate projects and providing growth financing for business owners. The company was recently named to the Inc 5,000 list of the fastest growing companies in America. Chris is also an executive coaching client of CEO Coaching International.

Overview: BIG growth sometimes requires spending BIG cash. And if you don’t want to give up equity to get the cash, what are your options? On today’s show, Chris Hurn explains the debt financing options CEOs should explore before they start breaking off chunks of equity that they may regret parting with in the future.

Chris Hurn on Acquisitions as a Growth Tool:

“Something I’m seeing that is very popular right now is business acquisition as a way to turbocharge your growth. There’s this interesting statistic that about 9,000 baby boomers are retiring every single day for the next nine years. And why that’s interesting to a business owner is that they own 56% of all the small-to-mid-sized companies in America. So there’s going to be a huge transfer of ownership of businesses out there. Not all of them obviously are saleable. A lot of businesses will be shut down. But there’s going to be an opportunity for a lot of business owners to consider acquiring another business. It’s not just a big business growth strategy. It can be a small-to-mid-size business growth strategy.”

Chris Hurn on Guarding Your Equity:

“There’s a lot of business owners that watch too much ‘Shark Tank’ and feel like the best way to grow is to give away a piece of ownership. And while that can make sense, in some cases, there’s a lot of debt capital options out there that I wish more business owners would consider before they jump in and only fuel their growth from their profits. Which is okay, but it’s probably not going to give you the kind of growth you want long term. Or, alternatively, they bring on private equity capital, and you don’t have to give away a part of the business. There’s an old saying that ‘Debt is cheaper than equity.’ And that usually turns out to be true if you’re very successful.

Chris Hurn on Staying Profitable by Sharpening Focus:

“I’ve only foreclosed on one business in 23 years. I think that’s a testament to the quality of underwriting that we do. But I’m sure there’s going to be some write-offs in the future just based on what we’ve gone through the last couple of years. Some industries in particular have been decimated. I guess it comes down to if a business owner executes and they have a good strategy, there’s usually no problem. It’s when they deviate from the strategy too far, or they have some inability to execute, that’s when they get into trouble. Sometimes business owners get seduced into doing things that they probably shouldn’t on a business level. A lot of businesses have not thought through their most profitable products or services and taken the pains of cutting out the lower profit ones.”

Links:

Using a Monthly Financial Review Checklist to Monitor Your Business’s Overall Health A monthly financial review can help to keep your plans and your available resources in sync, while also shining a spotlight on any activities or subpar employees who could be dragging you into the red.

4 Steps to Staggering Profit Growth Profit is the fuel every business needs to move forward. Yet in many businesses, profit happens more by accident than by design.

About CEO Coaching International

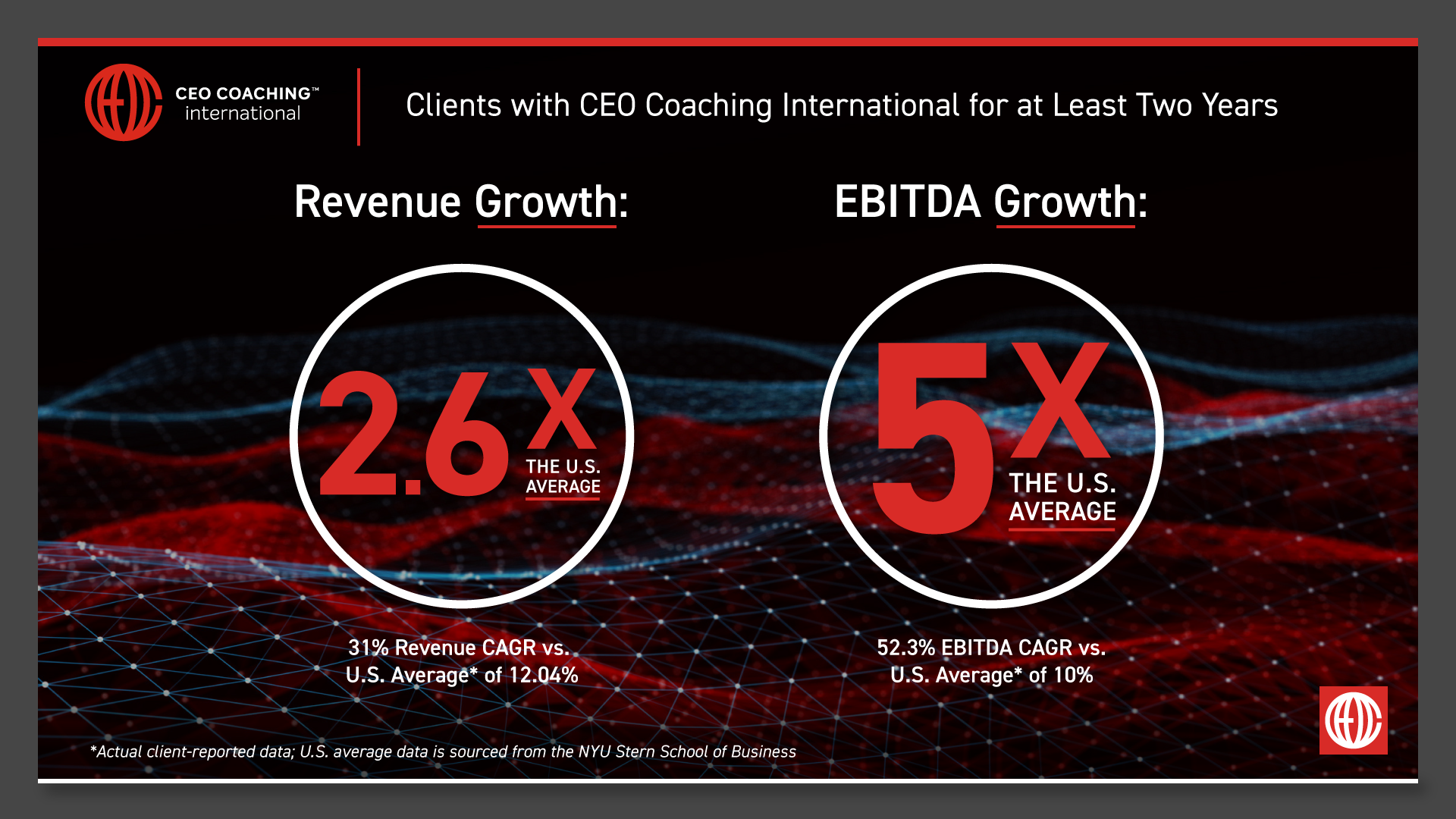

CEO Coaching International works with CEOs and their leadership teams to achieve extraordinary results quarter after quarter, year after year. Known globally for its success in coaching growth-focused entrepreneurs to meaningful exits, CEO Coaching International has coached more than 1,000 CEOs and entrepreneurs in more than 60 countries and 45 industries. The coaches at CEO Coaching International are former CEOs, presidents, or executives who have made BIG happen. The firm’s coaches have led double-digit sales and profit growth in businesses ranging in size from startups to over $10 billion, and many are founders that have led their companies through successful eight, nine, and ten-figure exits. Companies working with CEO Coaching International for two years or more have experienced an average revenue CAGR of 31% (2.6X the U.S. average) and an average EBITDA CAGR of 52.3% (more than 5X the U.S. average).

Learn more about executive coaching | Meet our world-class coaches