Why Cash Flow Can Make or Break Your Growth Strategy

When you first engage with a coach at CEO Coaching International, they’ll tell you that top CEOs focus on only five things: Vision, Cash, People, Key Relationships, and Continuous Learning.

All of those areas are important for your business to grow. But ask our top coaches and they’ll tell you that it’s cash flow that often holds teams back from BIG growth.

“If there’s no cash, they’re not going to be able to achieve the rest of their goals,” says CEO coach Keith Corrigan. “Do we have the cash to go do what we want? Because any growth strategy won’t work without the right levers pulled, and to do that, you need cash.”

Why Cash Flow Is the First Issue Coaches Examine

The first thing a coach will help you work through is your financial picture. Profit isn’t the same as cash—just ask global powerhouse Amazon, which was famously unprofitable for 14 years after its IPO in 1997. As your company grows and invests in people, equipment, and space, you start to work through your cash fast.

Says CEO Coach Edward Hughes, “What we look for first are those opportunities to have a high impact win right away. Can we help the CEO identify some waste or some costs that they don’t need to have? Or is it that we need the sales team to close deals faster and accelerate our cash flow?”

With a clear understanding of the money going in and out of your business, you’ll know how much cash you have on hand, which can be used to pay debts, expenses, and vendors. Analyzing a cash flow statement also allows you to make informed financial decisions, such as identifying areas to cut costs or generate cash.

How a Cash Bridge Dashboard Creates Financial Clarity

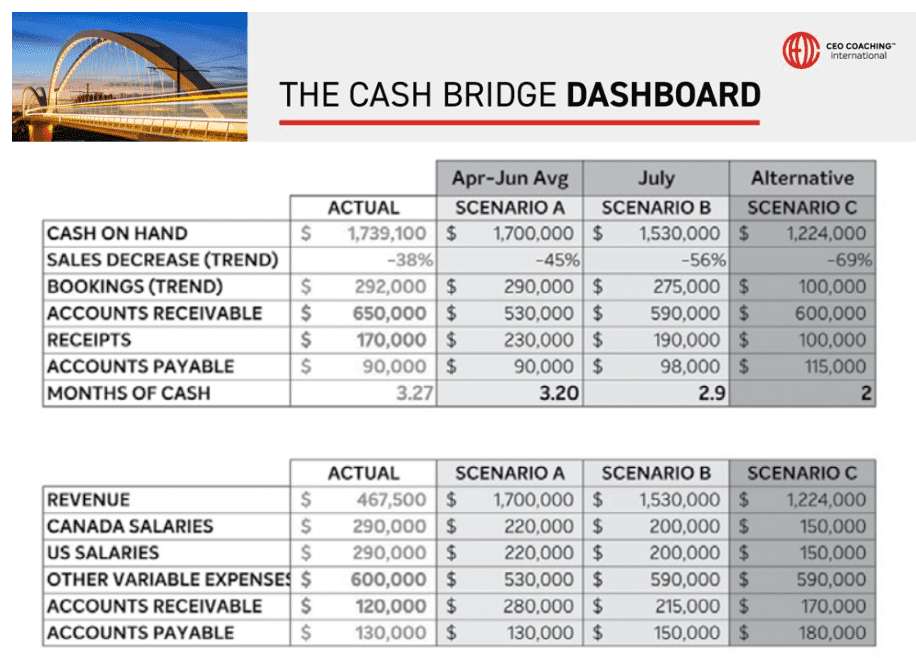

Our coaches always help clients set up a Cash Bridge Dashboard:

- Start by listing key drivers of your cash bridge and any leading indicators of future cash contributions.

- Draw up multiple scenarios that stress-test your cash flow with increasing severity.

- Compare your actual month-to-date data with these worst-case scenarios to know which one is currently in play.

- Highlight the variables meeting or exceeding expectations of the most favorable version of the model to help you isolate where you need to pay the most attention.

Your Cash Bridge will help you look at both sides of the cash flow equation: Money coming in…and money going out.

Are You Generating Enough Cash to Fund Growth?

There are always ways to cut costs. But you may not be generating enough in the first place. “This is where we dig into your processes,” says Corrigan. “Where can you generate more cash? Are you creating re-work cycles? Where is the cash coming in, and where is it flowing out?”

Our coaches generally recommend that your company can turn 80% of its EBITDA into free cash flow at any time. Whether you use a discounted cash flow, earnings multiplier, book value/liquidation valuation, or another valuation model, a company with solid cash flow has significant negotiating leverage and can achieve excellent exit multiples.

Are You Collecting Cash as Efficiently as You Earn It?

Your P&L may show profit, but if it is tied up in accounts receivable, payables, accrued expenses, or inventory, you have a problem. Sometimes, a cash flow issue is more around the process of collecting the cash, not just generating it.

Says Corrigan, “Everything might be good, but if you have receivables out over 120 days, that’s when you need to shore up your collection process and understand what’s going on with your clients.”

This is where it’s important to listen to your customers and understand what’s working (and what’s not) in your current product and services flow. For example, Corrigan remembers a client who had a customer who could never find their invoice. “The client didn’t believe that the customer could just lose a slip. But when we dug deeper, we figured out their invoice was going to their spam filters every time. If you don’t provide that in a nice package, it can take weeks to get paid.”

It can be as small a tweak as a delivery or packaging change that can make a big difference in your cash flow—you just need to take the time to really dig into the process to find out.

When a “Cash Problem” Is Actually a Strategy or People Problem

What a coach will really do is ask the right questions to determine if your problem is your cash flow…or if it’s hiding a bigger issue, like not having the right people in the right seats. Says Hughes, “As you peel back the onion, it becomes clear that what starts as a financial issue quickly becomes a strategy or a people issue. I was working with a client in the freight brokerage business, and through our conversations, we realized they didn’t have a differentiator beyond cost, which wasn’t working. The CEO thought they had poor-performing people, but really, they were being set up to fail.”

The Bottom Line: Growth Starts with Cash Mastery

By shining a light on pricing, margin discipline, and cost structure, coaching creates near-term EBITDA uplift. “As leaders, we all have our own blind spots,” he adds. “We have our own skill sets and our experiences that have shaped us. Having someone who can challenge those spots and push your thinking can open you up to new ideas and grow BIGGER.”

Ready to See How Coaching Can Strengthen Your Cash Flow?

Connect with a Coach >

About CEO Coaching International

CEO Coaching International works with CEOs and their leadership teams to achieve extraordinary results quarter after quarter, year after year. Known globally for its success in coaching growth-focused entrepreneurs to meaningful exits, the firm has coached more than 1,500+ CEOs and entrepreneurs across 100+ industries and 60 countries. Its coaches—former CEOs, presidents, and executives—have led businesses ranging from startups to over $10 billion, driving double-digit sales and profit growth, many culminating in eight, nine, or ten-figure exits.

Companies that have worked with CEO Coaching International for two years or more have achieved an average revenue CAGR of 25.9%, nearly 3X the U.S. average, and an average EBITDA CAGR of 39.2%, more than 4X the national benchmark.

Discover how coaching can transform your leadership journey at ceocoachinginternational.com.

Learn more about executive coaching | Meet our world-class coaches