Family-run businesses are understandably focused on preserving heritage. But the most effective leaders of family-run businesses know that a keen awareness of the future is just as important to set the company up for success for generations to come.

When it comes to planning for the future – what time is the right time to make key leadership decisions? How should decisions be made and who should make those decisions?

We sat down with CEO Coaching International Partner and Coach Mike Marchi, an expert on family business, to discuss all things Succession Planning.

From complex family dynamics to proper timing, here are Mike Marchi’s 4 ways to properly time succession planning.

1. It’s never too early to talk about succession planning.

One of the most common pitfalls family business leaders make is waiting too long to make important decisions about the future of the business.

Mike says leadership decisions are often delayed because the CEO, patriarch, or matriarch “never wants to let go or can’t let go because their whole life is built into the business.” In these cases, Mike says conversations about transitioning leadership only become more complicated with time.

Even more difficult is managing a health issue or catastrophic event that results in the death or incapacitation of a family business leader.

“That is a real eye-opener,” Mike says. “By having Succession Planning conversations earlier and then deciding on the right time for transition, gradually transitioning, and then making those announcements, families are more likely to have a successful succession of leadership. It is a best practice.”

2. Don’t delay on uncomfortable conversations.

Another aspect of Succession Planning leaders often delay on? Uncomfortable conversations with spouses-to-be about prenuptial agreements intended to preserve the structure of the company into the future.

“If the CEO or founder wants the company to stay in the family and the family blood, thinking about that early is very wise. If family members wait too long, it can make family dynamics difficult, and then it can get even more complicated,” Mike says.

This can get particularly contentious, especially with siblings who might be in the running to take over the company, Mike says. Many family-owned companies want to keep the perpetuity of the company in the family and don’t want family changes to disrupt the family vision for the firm. An engaged or soon-to-be-engaged sibling might feel as though they’ll never get a divorce and “it’s wrong to ask a fiancée or girlfriend or boyfriend to sign a prenup.”

The best way to handle this situation, according to Marchi, is an honest conversation – once again, sooner than later.

“I recommend the CEO have a conversation with their son or daughter and the significant other that are going to be married after the engagement and well ahead of the wedding. It is even better to be discussing this with your child even before they get serious with any partner so they know the vision for how company ownership continuity is designed, and they understand that you will have the conversation with them and their fiancé when the time comes. The message can be ‘look, we love you, we want you to be part of this family. But, at the end of the day, this is about keeping company continuity from generation to generation and so we are going to ask you to sign a prenup agreement. It’s an absolute that has to be established.”

3. Some thingswilltake time.

While early is better than later for family-run business leaders to consider their Succession Plan and get marital paperwork in order, sometimes, time is needed to make sure the heir to the CEO is the right fit.

“I would not say it’s ever too early to be talking about who might take over the family business, but it might be a 10 to 15-year process to define who that really might be,” Mike says.

“Talking to family members about their future in the business when they’re young adults and as they’re going to college is key,” Mike says. “Are you interested in coming into the business? Are you looking forward to it? Do you want to come in and work?”

CEOs should help facilitate opportunities for interested heirs to be tested in various roles in the family business (even if that means making wise use of summers off from college), so the potential heir can gain experience and the CEO can observe.

“Maybe the family-run business has a manufacturing or distribution function,” Mike says. “When the heir gets exposure and experience with the matriarch or the patriarch periodically observing how they run things, if you give it the right amount of time, some things might naturally kind of happen. And, perhaps, there’s a sibling who realizes family business isn’t what I thought it was to run it on a day-to-day. I’m not interested.”

It’s never too early to talk about family members coming into the business and working their way up through the business with the potential to take over as CEO. The proper pre-work to identify the right successor will ensure a better and more seamless transition for the family business.

4. Let family members leave the nest before returning.

There is high value in letting potential heirs gain experience in the family business, but, Mike says, there’s value in encouraging them to gain experience elsewhere, too.

“In the most effective Succession Plans I’ve seen, family members go out in the real world and work for a public, private, or private equity-owned company. They learn business without being an owner or the owner’s sibling. You don’t want them to have their whole life experience only in the family business. You want them to experience the real world,” Mike says.

Three to five years or so outside of the family business is a good amount of time for the potential successor to gain experience. That individual will either bring that experience back to the family business or will decide they would prefer to build a career outside of the family business. “People will learn. Some will feel comfortable. Some will say, look, this isn’t for me,” Mike says. “It will play out over time.”

About CEO Coaching International

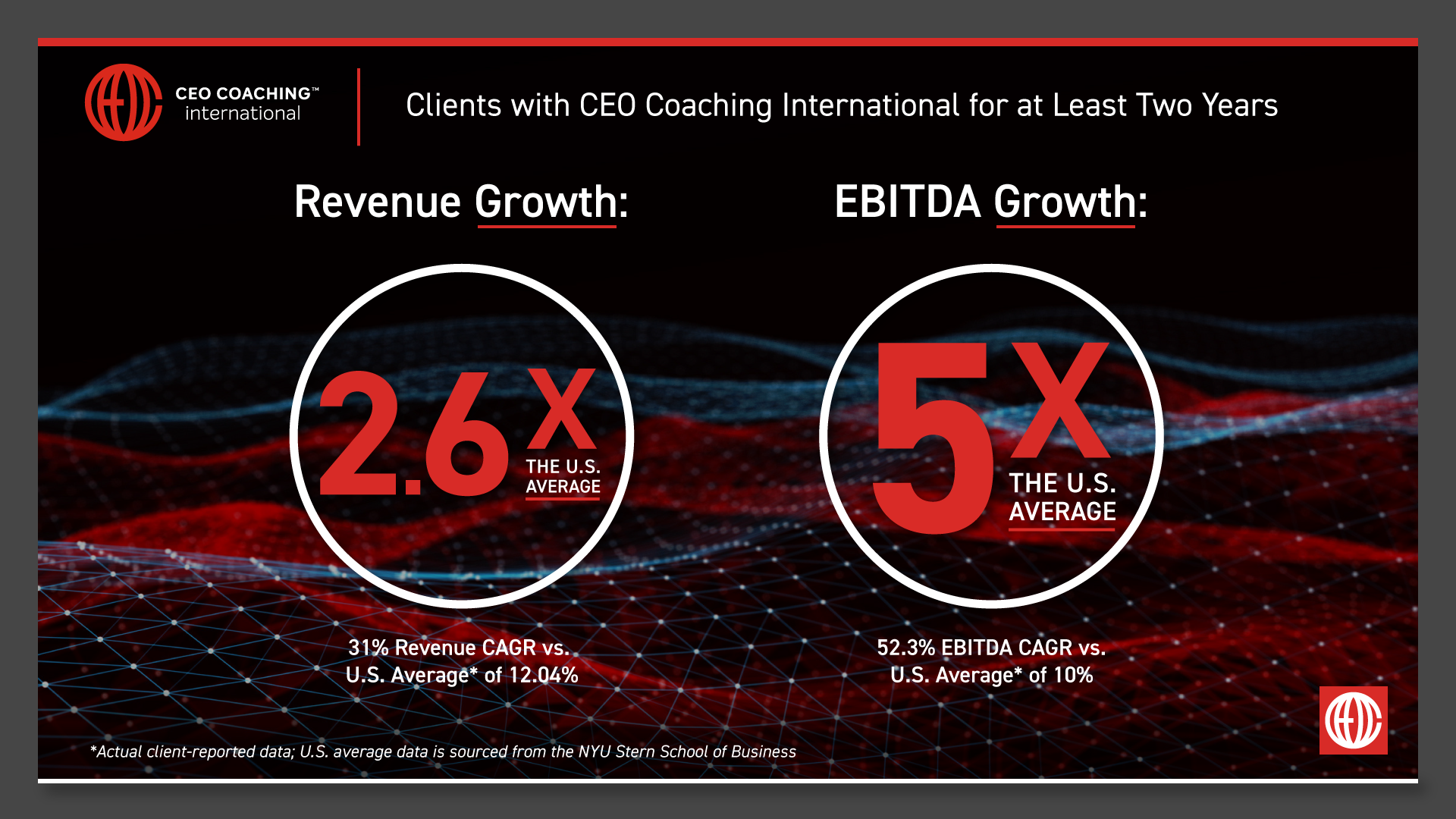

CEO Coaching International works with CEOs and their leadership teams to achieve extraordinary results quarter after quarter, year after year. Known globally for its success in coaching growth-focused entrepreneurs to meaningful exits, CEO Coaching International has coached more than 1,000 CEOs and entrepreneurs in more than 60 countries and 45 industries. The coaches at CEO Coaching International are former CEOs, presidents, or executives who have made BIG happen. The firm’s coaches have led double-digit sales and profit growth in businesses ranging in size from startups to over $10 billion, and many are founders that have led their companies through successful eight, nine, and ten-figure exits. Companies working with CEO Coaching International for two years or more have experienced an average revenue CAGR of 31% (2.6X the U.S. average) and an average EBITDA CAGR of 52.3% (more than 5X the U.S. average).

Learn more about executive coaching | Meet our world-class coaches