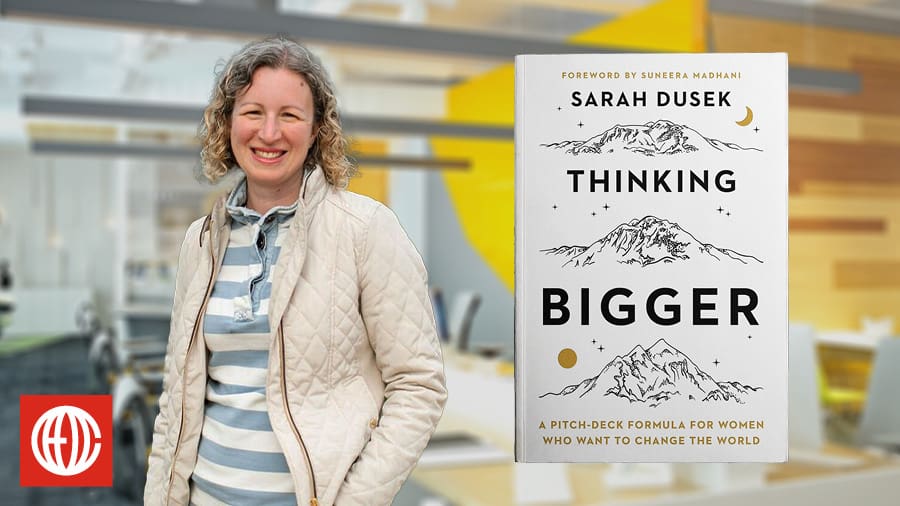

Guest: Sarah Dusek, the founder of Under Canvas, the leading upscale outdoor hospitality brand that she grew to a value of over $100 million. Today, Sarah is a venture capitalist, a cofounder of a new hospitality company, and the author of the new book, Thinking Bigger: A Pitch-Deck Formula for Women Who Want to Change the World.

Overview: In 2012, Sarah Dusek’s “glamping” company was starting its first season at Yellowstone National Park. One fateful afternoon, a huge thunderstorm rolled in and flattened the campsite, and, seemingly, Sarah’s dream.

But Sarah, her husband, her employees, and even her customers rallied. She rebuilt her business model with an eye toward repeatability and scale. And as the company began to get to BIG, Sarah began “thinking bigger” as well.

On today’s show, Sarah Dusek describes her incredible journey from the brink of collapse to building a $100-million industry leader. She also shares lessons from her new career in VC about what makes a business investible.

Sarah Dusek: “I really wrote this book to help other people learn from things that I didn’t know, the mistakes that I made on my journey, and to help people craft a story that not only sells your business, but really sells you as someone who has enormous potential to do something extraordinary.”

Sarah Dusek on overcoming her darkest moment:

“The only way I survived that moment was a member of staff said to me, ‘It’s really not that bad. I think we can come back from this. Let’s get to work.’ And he really slapped me out of my distress and my own sense of, ‘We’ve failed, it’s all so terrible,’ and really made me get back up. And we put that camp back together. And by about 11 that night, we had everybody back in their beds with clean, dry linen. We had every tent re-erected and the camp looked like the storm had never been. I did not give one refund that night. Not one guest departed and guests started to help us put the camp back together. It really made me realize we can’t do this alone. Anytime we try and build and scale and grow a business, we’re going to hit a wall, whether that’s metaphorically or physically. And sometimes we need other people to help us get back up. We are constantly facing battles and challenges in business. That’s just being in business. And the real issue is how you handle it. It’s not whether it will come. When it comes, how are you going to navigate it? And are you going to have the capacity and the strength to get yourself back up.”

Sarah Dusek on finding the courage to say no to the wrong equity partner:

“I was so relieved and so thankful that finally I got someone to say yes. Except, as we started to get into the nitty-gritty of it all, and started to wrangle on the terms, there were a few flags that came up for me. And every time a flag came up, I would just dismiss it and say, ‘Oh, that’s maybe the way they’re used to doing business. I don’t do business like that, but I’ll go with it because they’ve got the money.’ And I would ignore it. And then there would be another thing that would happen and I would have to go, ‘I don’t like that, but okay, let’s put that under the rug too.’ And I had kept sweeping under the carpet until the carpet was no longer able to stand on top of all the red flags.

“Finally, I got another response that was so glaringly awful that it made me think, ‘I can’t do business with you.’ I called back a couple of days later and said, ‘We can’t do this deal. Thank you very much for all the time and energy you’ve spent on it, but we can’t do it.’ And he went crazy, and all the red flags that I had stored up under my rug were flying everywhere.

“So it was a devastating moment because we really needed the capital to grow the business. But it taught me an amazing lesson.

“When you’ve got a red flag that someone’s flying up in front of you, never ignore it.

“If someone’s showing you who they are, believe them.

“If they’re showing you before you’re in business with them, that they are not someone you want to do business with, definitely do not.

“And it was like a growing-up moment of who do I want to be in business? How do I want to do business? And what kind of partners do I need to do business with?”

Sarah Dusek on telling — and selling — your story:

“Investors are always investing in people—a hundred percent. Investors are looking for extraordinary people to make things happen. That’s how investors make money, right? You make extraordinary things happen and build an extraordinary business. So an average idea in the hands of someone extraordinary, who’s going to really take that idea and milk it for all it’s worth is definitely preferable for an investor than someone who’s got the best idea, but you can’t execute on it and you don’t have the capabilities to make it happen. Investment is all about you. And the pitch deck is really just a tool for telling your story and making sure you tell the story in a way that makes you and your business compelling.”

Links:

The Power of Knowing What You Want – Sarah spoke at the Make BIG Happen Summit about how she led Under Canvas from near disaster to a 32X Multiple of EBITDA.

Partnering With Private Equity to Drive BIG Business Growth – Dr. Madan Kandula shares valuable insights on balancing profit with mission and how to effectively partner with private equity firms without compromising your vision for serving clients and Making BIG Happen.

About CEO Coaching International

CEO Coaching International works with CEOs and their leadership teams to achieve extraordinary results quarter after quarter, year after year. Known globally for its success in coaching growth-focused entrepreneurs to meaningful exits, the firm has coached more than 1,500+ CEOs and entrepreneurs across 100+ industries and 60 countries. Its coaches—former CEOs, presidents, and executives—have led businesses ranging from startups to over $10 billion, driving double-digit sales and profit growth, many culminating in eight, nine, or ten-figure exits.

Companies that have worked with CEO Coaching International for two years or more have achieved an average revenue CAGR of 25.9%, nearly 3X the U.S. average, and an average EBITDA CAGR of 39.2%, more than 4X the national benchmark.

Discover how coaching can transform your leadership journey at ceocoachinginternational.com.

Learn more about executive coaching | Meet our world-class coaches